Working capital utilization factor: characteristics, indicators and calculation formula. Tsii (works, services). Load factor of funds in turnover opre Load factor of working capital shows

- Financial result: transformation of the concept B A Reisberg's dictionary L Sh Lozovsky E B Starodubtseva

- The need to take into account other income and expenses in marginal analysis Dictionary Edited by AN Azriliyan M Institute of New Economics 2004. 2. Lukasevich I Ya ... Financial management textbook M Eksmo 2007. 3. Finance of enterprise organizations Edited by NV Kolchina

- Financial strategy and approaches to determining the potential of an enterprise, financial and production potential and strategy as a necessary element for its development LITERATURE 1. Dictionary of foreign words Ed by I. A. Vasyukov M 1972. 2.

Working capital utilization factor: calculation for the project

Current assets are the most important factor in the production process and occupy a fairly large share in the total value of the property of the enterprise. Therefore, it is necessary to rationally approach the value of mobile assets and plan their values.

Attention

For this, indicators of the efficiency of working capital exploitation are used (turnover ratio, load factor, profitability, etc.) Table of contents: 1. The essence of the indicator2. How to calculate the turnover ratio of working capital3.

Analysis and normative value of the turnover ratio of current assets The essence of the indicator This indicator is considered basic when planning the required amount of mobile funds, as it reflects the number of turnovers of funds for the period.

Financial vocabulary

Important

Possible reasons for the decrease Turnover slowdown may occur due to an increase in the duration of one turnover, the causes of which are unjustified growth of stocks, the appearance of buyers' debts, a failure in the production process and, as a result, unfinished products. Also, possible reasons include a decrease in demand, due to which finished products remain in stock longer, production volumes are falling.

In general, the turnover ratio of working capital makes it possible to sufficiently qualitatively assess the efficiency of operating working capital. But for a more complete and objective assessment, it is advisable to calculate other indicators of efficiency and liquidity stability.

Video - current assets of the enterprise and the efficiency of their use in the form of a turnover ratio: (13 votes, average: 4.80 out of 5) Loading ...

Calculation of the company's working capital turnover ratio

Accelerating the turnover of working capital and releasing them as a result of this in any form will allow the enterprise to allocate funds for development without attracting additional financial resources. Improvement in the use of working capital can be achieved through:

- economical and rational use of material resources;

- optimization of the size of inventories and backlogs of work in progress;

- accelerate the turnover of working capital.

Determining the need for working capital.

To determine the needs of the enterprise in working capital, the rationing of working capital is carried out. Rationing of working capital is the process of determining the minimum, but sufficient (for the normal course of the production process) amount of working capital at the enterprise.

Analysis of the turnover of funds - ratio and indicators

The turnover of working capital (duration of one turnover, days) (Add) shows how long it takes for the company to return its working capital in the form of proceeds from the sale of products, calculated by the formula: Add \u003d Dk / Kob, or Add \u003d SOobs × Dk / Vr , where Dk is the number of calendar days in the period under review, days. Working capital utilization factor (Kzag) in turnover shows the amount of working capital attributable to 1 ruble of sold products, is found by the formula: Kzag \u003d COob.s / Vr. The coefficient of efficiency (profitability) of working capital (Kef) shows how much profit from the sale of products falls on 1 ruble of working capital, is calculated by the formula: Kef \u003d Preal / COob.s, where Preal is the profit from sales in the period under review, rub.

Turnover ratios (indicators of business activity)

Of particular importance in the activities of each subject is the analysis of changes in the movement of working capital and means of circulation, which is carried out in relation to the pace of production. What is required to work with working capital? Duration of turnover Work with the assets of the enterprise should bring benefits to its owner.

Info

In this case, analysis is indispensable. The following indicators serve as a characteristic of the expediency of using working capital:

- Load factor

- Indicator of intensity of use (turnover)

- Turnover duration

These factors make it possible to assess the quality of working capital management. Definition of indicators This ratio is the ratio of proceeds from the sale of goods to the value of working capital, which are listed on the balance sheet of the organization.

How to calculate the turnover of working capital in days according to the balance

Rationing of working capital depends on the following factors:

- the duration of the production cycle of manufacturing products;

- consistency and clarity in the work of procurement, processing and manufacturing shops;

- supply conditions;

- remoteness of suppliers from consumers;

- speed of transportation, type and uninterrupted operation of transport;

- the time of preparation of materials for the launch of their production;

- conditions for the sale of products;

- systems and forms of settlements, speed of document flow, possibilities and forecasting of factoring4

The following elements of working capital are normalized:

- productive reserves;

- unfinished production;

- Future expenses;

- finished products in the warehouse of the enterprise.

Working capital turnover ratio

The data will allow you to find the indicator only for the year, it is impossible to calculate other periods according to the balance sheet information. Methodology (formula) for calculating the turnover ratio of current assets on the balance sheet: Tr = p.

2110 OFR / (line 1200np BB + line 1200kp BB) / 2, where Tr (turnoverratio) - the turnover ratio of working capital, about / year; line 2110 OFR - revenue according to the statement of financial results, rub.; line 1200np BB - the amount of working capital at the beginning of the year, rub.; line 1200kp BB - the amount of working capital at the end of the year, rub. An example of a balance sheet calculation It is necessary to calculate the turnover ratio for 2014 using the example of Ekran LLC.

Line code As of December 31, 2013 As of December 31, 2014 II. CURRENT ASSETS Total for section II 1200 400 000 500 000 Revenue 2110 1500 000 1 800 000 Tr = 1800 000 / (400 000 + 500 000)/2 = 4 rev/year.

Current assets of the enterprise

In other words, the turnover ratio of working capital characterizes the efficiency of working capital exploitation in order to generate income from the main activity. Like any coefficient, the indicator is relative and reflects how many turns it takes to make mobile devices in order to provide a given rate of revenue.

How to calculate the turnover ratio of working capital In order to find this indicator, it is necessary to identify two values - income and working capital. Income in the planned calculation is reflected through the revenue indicator, and working capital - through the average balance of mobile funds.

The turnover ratio is found through the ratio of income and working capital. It is worth noting that the indicators should be comparable, that is, both the revenue and the cost of mobile funds should be taken for one period, for example, for a year.

Efficiency of the use of working capital: indicators, ways to improve. To analyze the use of working capital, assess the financial condition of an industrial enterprise and develop organizational and technical measures to accelerate their turnover, a system of indicators is used that characterize the actual process of working capital movement and the amount of their release. Efficient use of working capital helps to increase the financial stability of the enterprise and its solvency. Under these conditions, the enterprise timely and fully fulfills its settlement and payment obligations, which allows it to successfully carry out business activities.

Load factor of funds in circulation balance formula

A decrease in the load factor indicates an accelerated turnover rate, as a result of which there is a reduction in the turnover period during which it can produce and sell more, thereby increasing profitability and reaching a higher level of production. Therefore, an increase in the turnover rate and a decrease in the load factor indicate stable and productive work and create all the prerequisites for further improvement of the situation.

Maintaining the correct ratio of the income received from sales and the state of working capital will ensure solvency, as well as reach the organization to a new level. Noticed an error? Select it and press Ctrl+Enter to let us know.

Trade organizations should use working capital expediently and efficiently. This implies, firstly, the safety of own working capital, the inadmissibility of reducing their amount at the disposal of the enterprise. A necessary condition for the safety of own working capital is the cost-effective operation of the enterprise. Secondly, working capital (own and borrowed) must be used for specific purposes and in the amount provided for by the financial plan. Thirdly, working capital should be used efficiently, i.e. plans must be carried out with a minimum amount of working capital.

The effective use of working capital is understood as such their functioning, which ensures a stable state of finances, strictly observes financial and budgetary discipline, and achieves the highest results at the lowest cost.

The level of efficiency in the use of the total amount of working capital and their individual types is characterized by a system of cost and natural, quantitative and qualitative indicators.

The main indicators characterizing the efficiency of the use of working capital are the turnover ratio of working capital. It characterizes the amount of proceeds from sales per one ruble of working capital. It is calculated as the ratio of the amount of proceeds from the sale of products to the average balance of working capital:

K about \u003d BP / About cf,

where BP - sales proceeds, rub.;

About cf - the average balance of working capital, rub.

The turnover ratio of working capital is the return on assets of working capital. Its growth indicates a more efficient use of working capital.

The turnover of working capital is the duration of one complete turnover of funds, starting from the first and ending with the third phase

The duration of one turnover of working capital is calculated by the formula:

D about \u003d D p / K about,

where D p - the duration of the period for which the degree of use of the OS is determined.

In calculations, the duration of the year is 360, the quarter is 90, the month is 30 days.

The average balance of working capital of an enterprise is calculated by the formula:

About cf \u003d (He / 2 + O1 + O2 + O3 + Ok / 2) / (n-1),

where О i - the balance of working capital on the first day of the corresponding month, rub.;

n is the number of months in the analyzed period.

Also, to assess the efficiency of the use of working capital, the working capital utilization factor is calculated, which characterizes the amount of working capital advanced per one ruble of proceeds from product sales. In other words, it represents the current capital intensity, i.e. working capital costs for obtaining one ruble of sold products (works, services). The utilization rate of funds in circulation is the ratio of the average balance of working capital to the amount of proceeds from the sale of products:

K s \u003d About cf / BP

Another key indicator characterizing the efficiency of use is the profitability of working capital.

Profitability is called (profitable, useful, profitable), a relative indicator of economic efficiency. Profitability comprehensively reflects the degree of efficiency in the use of material, labor and financial resources, as well as natural resources. The profitability ratio is calculated as the ratio of profit to the assets, resources or flows that form it. It can be expressed both in profit per unit of invested funds, and in the profit that each received monetary unit carries. Profitability rates are often expressed as a percentage.

R about \u003d PE / O cf,

where NP is net profit.

And the final factor is liquidity - it means the ability of the enterprise to repay its obligations with assets, the period of transformation of which into money corresponds to the maturity of the obligations. The liquidity level of an enterprise is determined by liquidity ratios, the calculation of which is based on a comparison of current assets and short-term liabilities. The greater the excess of working capital over short-term liabilities, the more favorable the financial condition of the enterprise. Depending on what part of working capital relates to short-term liabilities, the following indicators are calculated to assess liquidity:

The current liquidity ratio or coverage ratio is a financial ratio equal to the ratio of current current assets taken into account when assessing the structure of the balance sheet - this is the result of the second section of the balance sheet of form No. 1 (line 290) minus line 230 (accounts receivable, payments for which are expected to be more than 12 months after the reporting date) to short-term liabilities - this is the result of the fourth section of the balance sheet (line 690) minus lines 640 (deferred income) and 650 (reserves for future expenses and payments). The data source is the company's balance sheet.

The coefficient is calculated by the formula:

K tl = current assets / short-term liabilities.

The ratio reflects the company's ability to repay current (short-term) liabilities at the expense of current assets only. The higher the indicator, the better the solvency of the enterprise. Liquidity ratios characterize the solvency of the enterprise not only at the moment, but also in case of emergency.

The normal value of the coefficient is from 1.5 to 2.5, depending on the industry. Both low and high ratios are unfavorable. A value below 1 indicates a high financial risk associated with the fact that the company is not able to consistently pay current bills. A value greater than 3 may indicate an irrational capital structure. But at the same time, it must be taken into account that, depending on the field of activity, the structure and quality of assets, etc., the value of the coefficient can vary greatly.

It should be noted that this ratio does not always give a complete picture. Typically, firms with low inventories and easily obtainable bills of exchange can easily operate at a lower ratio than firms with large inventories and sales of goods on credit.

Another way to check the sufficiency of current assets is to calculate urgent liquidity. Banks, suppliers, shareholders are interested in this indicator, since the company may face circumstances in which it will immediately have to pay some unforeseen expenses. This means that she will need all her cash, securities, receivables and other means of payment, that is, part of the assets that can be turned into cash.

Quick (term) liquidity ratio characterizes the company's ability to repay current (short-term) liabilities at the expense of current assets. It is similar to the current liquidity ratio, but differs from it in that the working capital used for its calculation includes only highly and medium liquid current assets (money in operating accounts, stock of liquid materials and raw materials, goods and finished products, accounts receivable). debt with a short maturity).

Such assets do not include work in progress, as well as inventories of special components, materials and semi-finished products. The source of data is the company's balance sheet in the same way as for current liquidity, but inventories are not taken into account as assets, since if they are forced to be sold, losses will be maximum among all current assets:

K bl \u003d accounts receivable + cash + short-term financial investments / short-term liabilities.

This is one of the important financial ratios, which shows what part of the company's short-term liabilities can be immediately repaid at the expense of funds in various accounts, in short-term securities, as well as proceeds from settlements with debtors. The higher the indicator, the better the solvency of the enterprise. The normal value of the coefficient is more than 0.8 (some analysts consider the optimal value of the coefficient 0.6-1.0), which means that cash and future receipts from current activities should cover the current debts of the organization.

To increase the level of urgent liquidity, organizations should take measures aimed at increasing their own working capital and attracting long-term loans and borrowings. On the other hand, a value of more than 3 may indicate an irrational capital structure, this may be due to the slow turnover of funds invested in inventories, the growth of receivables.

In this regard, the absolute liquidity ratio, which should be more than 0.2, can serve as a litmus test of current solvency. The absolute liquidity ratio shows what part of the short-term debt the organization can repay in the near future at the expense of the most liquid assets (cash and short-term securities).

Absolute liquidity ratio. A financial ratio equal to the ratio of cash and short-term financial investments to short-term liabilities (current liabilities). The source of data is the company's balance sheet in the same way as for current liquidity, but only cash and cash equivalents are taken into account as assets, the calculation formula is as follows:

K al \u003d cash + short-term financial investments / short-term liabilities.

A coefficient value of more than 0.2 is considered normal. The higher the indicator, the better the solvency of the enterprise. On the other hand, a high indicator may indicate an irrational capital structure, an overly high share of non-performing assets in the form of cash and funds in accounts.

In other words, if the balance of funds is maintained at the level of the reporting date (mainly by ensuring a uniform receipt of payments from counterparties), short-term debt as of the reporting date can be repaid in five days. The above regulatory limitation is applied in foreign practice of financial analysis. At the same time, there is no exact justification why, in order to maintain a normal level of liquidity of Russian organizations, the amount of cash should cover 20% of current liabilities.

Working capital turnover rate is the most important indicator of the intensity of their use and is determined using the following interrelated indicators:

· Turnover ratio;

Duration of one turnover in days;

· Working capital utilization factor.

Turnover ratio (Kob) shows the number of turnovers made by working capital for the year (half year, quarter) and is determined by the formula

Kob \u003d P / O, Where

P is the cost of products sold (sales proceeds) for a certain period;

O - the average balance of working capital for the same period (average annual cost of working capital).

The higher the turnover ratio, the better the use of working capital.

Example. P = 200 million rubles, O = 40 million rubles. (in a year)

Kob \u003d 200 / 40 \u003d 5 rev.

This means that for the year each ruble invested in working capital made 5 turns.

Index duration of one revolution in days does not depend on the duration of the period for which it was calculated. For example, 2 turnovers of funds in each quarter of the year will correspond to 8 turnovers per year with the same duration of one turnover in days.

The duration of one revolution in days is determined by:

D \u003d T / Kob, Where

Cob - turnover ratio;

T - duration of the period (T=30; 90: 360 days)

With Kob \u003d 5, the duration of one revolution will be 360 / 5 \u003d 72 days

Reducing the duration of one turnover indicates an improvement in the use of working capital.

Load factor working capital(Kz) - an indicator that is inverse to the turnover ratio:

Kz \u003d 1 / Ko \u003d O / R

It characterizes the amount of the balance of working capital attributable to 1 rub. sales proceeds.

In the considered example, Kz \u003d 1 / 5 \u003d 40 / 200 \u003d 0.2

For 1 rub. proceeds from the RP accounted for 20 kopecks of the value of working capital. The lower the value of the load factor of working capital, the more efficient use of working capital.

Acceleration or deceleration of fixed assets turnover is revealed by comparing the actual indicators with the planned or previous period. With the acceleration of the turnover of working capital (working capital), material resources and sources of their formation are released from circulation, with a slowdown, additional funds are involved in the turnover. The release of working capital can be absolute or relative.

R 2008 = 600 thousand rubles R 2009 = 612 thousand rubles

About 2008 = 120 thousand rubles About 2009 = 110.5 thousand rubles

K2008 = 600 / 120 = 5.0 K 2009 = 612 / 110.5 = 5.54

D 2008 = 360 / 5 = 72 days D 2009 = 360 / 5.54 = 65 days

Absolute release O 2008 - O 2009 = 120 - 110.5 = 9 thousand rubles of working capital compared to 2008. Relative release of working capital as a result of accelerated turnover:

Wtn \u003d Pz / T * (D 1 - D 2)

Votn \u003d 612 / 360 * (72 - 65) \u003d 11.9 thousand rubles, or in another way. The need for working capital in 2009 with the turnover in 2008 and the volume of sales in 2009 is equal to

612 * 72 / 360 = 122.4 thousand rubles

The relative release of working capital will be:

122.4 - 110.5 \u003d 11.9 thousand rubles.

Current assets are the most important factor in the production process and occupy a fairly large share in the total value of the property of the enterprise. Therefore, it is necessary to rationally approach the value of mobile assets and plan their values. For this, indicators of the efficiency of working capital operation are used (turnover ratio, load factor, profitability, etc.)

The essence of the indicator

This indicator is considered basic when planning the required amount of mobile funds, as it reflects the number of turnovers of funds for the period. In other words, the turnover ratio of working capital characterizes the efficiency of working capital exploitation in order to generate income from the main activity.Like any coefficient, the indicator is relative and reflects how many turns it takes to make mobile devices in order to provide a given rate of revenue.

How to calculate the turnover ratio of working capital

In order to find this indicator, it is necessary to identify two quantities - income and working capital. Income in the planned calculation is reflected through the revenue indicator, and working capital - through the average balance of mobile funds.

The turnover ratio is found through the ratio of income and working capital.

It is worth noting that the indicators should be comparable, that is, both the revenue and the cost of mobile funds should be taken for one period, for example, for a year.

General calculation formula

The turnover ratio is measured in terms of the number of turnovers per period. In general, the formula for calculating the turnover ratio of working capital is presented as:

Tr = TR / C vol,

Tr (turnoverratio) - the turnover ratio of working capital, about / period;

TR (total revenue) – revenue, rub.;

C vol - the average value of mobile funds, rub.

The above indicators, in turn, are found according to the following algorithm:

TR = P*Q,

P (price) – unit price, rub.;

Q (quantity) - the number of manufactured and sold products, rub.

C about \u003d (C np + C kp) / 2,

C np - the amount of working capital at the beginning of the period, rub.;

C kp - the amount of working capital at the end of the period, rub.

Balance calculation formula

To find the turnover ratio, it is necessary to use the data of the income statement and the balance sheet.

The data will allow you to find the indicator only for the year, it is impossible to calculate other periods according to the balance sheet information.

Methodology (formula) for calculating the turnover ratio of current assets on the balance sheet:

Tr = line 2110 OFR / (line 1200 np BB + line 1200 kp BB) / 2,

Tr (turnoverratio) - turnover ratio of working capital, about / year;

line 2110 OFR - revenue according to the statement of financial results, rub.;

line 1200 np BB – amount of working capital at the beginning of the year, rub.;

line 1200 kp BB - the amount of working capital at the end of the year, rub.

Balance calculation example

Tr \u003d 1800,000 / (400,000 + 500,000) / 2 \u003d 4 rpm.

Thus, the turnover ratio for 2014 is 4 turnovers, that is, mobile funds will turn around four times over the period.

Analysis and normative value of the turnover ratio of current assets

The indicator needs to be calculated constantly and to reveal the dynamics for several years, because the data for one period does not give a general picture of the situation.

There are no specific normative coefficient values, but each enterprise sets a target value for itself.

In general, the more turnovers mobile capital makes, the higher the income will be, but at the same time, the release of working capital from operation will be observed.

Video - indicators of the effectiveness of the use of working capital:

The decrease in the coefficient compared to the previous period reflects a negative trend - the organization will not receive part of the revenue. To level the negative aspects, it is rational to involve additional mobile funds in production.

What most often depends on

We can single out a list of factors that most strongly affect the value of the coefficient under consideration.

Firstly, this indicator can be significantly changed by the time of working capital in inventories, receivables, unsold products in the warehouse and work in progress.

Secondly, the turnover ratio depends on changes in the duration of the technological and production cycles, staff qualifications, conditions for the sale of services, goods and works, and, in general, on the organization of the company's activities.

What does an increase in the turnover ratio of working capital lead to?

The growth of the indicator is more often perceived as a positive factor - the faster mobile funds turn around, the more revenue the company will receive. The acceleration of turnover leads to an improvement in other indicators of effect and efficiency - profit, etc.But there are also negative aspects to this - too much stock needs to be stored somewhere, and this entails additional costs. Due to the acceleration of turnover, productivity also increases, which leads to an increase in wages.

Therefore, before planning an increase in the coefficient, it is necessary to adjust not only the potential additional income, but also the associated increasing costs.

Possible reasons for the decline

A slowdown in turnover may occur due to an increase in the duration of one turnover, the causes of which are an unjustified increase in inventories, the appearance of buyers' debts, a failure in the production process and, as a result, work in progress.

Also, possible reasons include a decrease in demand, due to which finished products remain in stock longer, production volumes are falling.

In general, the turnover ratio of working capital makes it possible to evaluate quite qualitatively. But for a more complete and objective assessment, it is advisable to calculate other indicators of efficiency and liquidity stability.

Video - working capital of the enterprise and the efficiency of their use in the form of a turnover ratio:

5. Indicators of the effectiveness of the use of working capital

Improving the use of working capital with the development of entrepreneurship is becoming increasingly important, since the material and financial resources released in this case are an additional internal source of further investment. Rational and efficient use of working capital helps to increase the financial stability of the enterprise and its solvency. Under these conditions, the enterprise timely and fully fulfills its settlement and payment obligations, which allows it to successfully carry out commercial activities.

The efficiency of the use of working capital is characterized by a system of economic indicators, primarily the turnover of working capital.

Under the turnover of working capital is understood the duration of one complete circulation of funds from the moment of the transformation of working capital in cash into inventories and until the release of finished products and its sale. The circulation of funds ends with the transfer of proceeds to the account of the enterprise.

The turnover rate of working capital is calculated using three interrelated indicators:

- turnover ratio (the number of turnovers made by working capital for a certain period (year, half year, quarter));

- the duration of one revolution in days,

- the amount of working capital per unit of products sold.

The calculation of the turnover of working capital can be carried out both according to the plan and actually.

The planned turnover can be calculated only for the normalized turnover of funds, the actual one - for all working capital, including non-standardized ones. Comparison of planned and actual turnover reflects the acceleration or deceleration of the turnover of normalized working capital. With the acceleration of turnover, working capital is released from circulation, with a slowdown, there is a need for additional involvement of funds in circulation.

The turnover ratio is defined as the ratio of the amount of proceeds from the sale of products, works, services to the average balance of working capital according to the formula (Fig. 7.29):

K about \u003d P / C,

where P is the net proceeds from the sale of products, works, services, rubles;C - average balances of working capital, in rubles.

Rice. 7.29. Methodology for calculating the turnover ratio

The turnover of working capital can also be presented in days, that is, reflect the duration of one turnover (Fig. 7.30).

The duration of one revolution in days is determined by the formula:

O \u003d C: R / D or O \u003d D / K about,

where O is the duration of one revolution in days;C - balances of working capital (average annual or at the end of the upcoming (reporting) period), rubles;P - revenue of marketable products (at cost or in prices), rubles;D - the number of days in the reporting period.

Rice. 7.30. Calculation of the duration of one turnover in days

To determine the duration of one turnover of receivables, you can use the indicator of sales in selling prices. First, the volume of sales for one day is calculated, and then the urgency of the receivables.

The calculation is made according to the formula:

OD = DZ: Oh,

where OD is the duration of the turnover of receivables (in days);DZ - accounts receivable at the end of the year;O is the volume of sales per day.

The period required for the conversion of all working capital into cash is the sum of the duration of one turnover of inventory in days and the urgency (duration) of one turnover of receivables.

The working capital utilization factor is the reciprocal of the turnover ratio (Fig. 7.31). It characterizes the amount of working capital per unit (1 ruble, 1 thousand rubles, 1 million rubles) of sold products. At its core, this indicator represents the capital intensity of working capital and is calculated as the ratio of the average balance of working capital to the volume of product sales for the analyzed period. Calculated according to the formula:

K z \u003d C / P,

where K z - working capital utilization factor;C - average balance of working capital, rub.;P - proceeds (net) from the sale of products, works, services, rub.

Rice. 7.31. Load Factor Calculation

Example: Over the past year, the volume of marketable products at cost amounted to 350,000 thousand rubles. The average balance of working capital for the same period is 47,800 thousand rubles. Determine the performance indicators for the use of working capital by the enterprise.

The calculation is carried out in the following sequence:

1. The turnover ratio is determined: 350,000 / 47,800 = 7.3 turns. That. for the year, working capital made 7.3 rounds. In addition, this indicator means that for every ruble of working capital, 7.3 rubles of sold products accounted for.

2. The duration of one revolution is calculated: 360 / 7.3 = 49.3 days

3. The load factor is determined: 47,800 / 350,000 = 0.14.

In addition to these indicators, the indicator of return on working capital can also be used, which is determined by the ratio of profit from the sale of the company's products to the average balances of working capital (Fig. 7.32).

Rice. 7.32. Return on current assets

Turnover can be defined as general and as private.

General turnover characterizes the intensity of the use of working capital in general for all phases of the circulation, without reflecting the features of the circulation of individual elements or groups of working capital.

Private turnover reflects the degree of use of working capital in each phase of the cycle, in each specific phase of the cycle, in each group, as well as for individual elements of working capital.

To determine the impact of structural changes, the balances of individual elements of working capital are compared with the volume of marketable products (T), which was taken when calculating the total turnover of working capital. In this case, the sum of the indicators of private turnover of individual elements of working capital will be equal to the indicator of the turnover of all working capital of the enterprise, that is, the total turnover.

The quantitative result of the efficiency of the use of working capital is their release from circulation (with an acceleration of turnover) or additional involvement in economic turnover (with a slowdown in the turnover of working capital) (Fig. 7.33).

Rice. 7.33. Consequences of acceleration and deceleration of working capital turnover

Release can be absolute or relative.

Absolute release of working capital takes place when the actual balance of working capital is less than the standard or the balance of working capital for the previous (base) period while maintaining or increasing the volume of sales for this period.

The relative release of working capital takes place in cases where the acceleration of the turnover of working capital occurs simultaneously with the growth in production at the enterprise, as a result, the growth rate of sales outstrips the increase in working capital.

The funds released at the same time cannot be withdrawn from circulation, as they are in inventories of goods and materials, which ensure the growth of production.

The relative release of working capital, like the absolute one, has a single economic basis and significance, or it means additional savings for an economic entity and allows for an increase in the scale of entrepreneurial activity without attracting additional financial resources.

Example: It is known that for the previous year, the proceeds from the sale of products (in pg) amounted to 6,000 million rubles, for the current year (in tenge) - 7,000 million rubles. The average balance of working capital in the previous year (OS pg) - 600 million rubles, in the current year (OS tg) - 500 million rubles. The number of days in period D is 360 days. Determine the magnitude of the absolute and relative release of working capital from economic turnover.

The calculation is made in the following sequence:

1. The turnover ratios are calculated:

Previous year (KO pg) = 6,000 / 600 = 10 revolutions

Current year (KO tg) = 7,000 / 500 = 14 turns

2. The duration of one revolution in days is determined:

In the previous year (D pg) = 360 / 10 = 36 days

In the current year (D tg) = 360 / 14 = 25.71 days

3. Load factors are determined:

Previous year (KZ pg) = 600 / 6000 = 0.1

Current year (KZ tg) = 500 / 7000 = 0.07142

4. Two methods can be used to calculate the release of working capital.

Method 1: The total amount of release of funds from the economic turnover is calculated according to the formula V = (D tg - D pg) × V tg / D; absolute release: V ab = OS pg - OS tg; relative release: B rel = B - B ab.

According to the task:

B \u003d (25.71 - 36) × 7000 / 360 \u003d (-200) million rubles.

Vab = 500 - 600 = (-100) million rubles

Votn \u003d (-200) - (-100) \u003d (- 100) million rubles.

Method 2: The total amount of release from economic circulation is calculated by the formula B = (KZ tg - KZ pg) × V tg; absolute release: V ab \u003d OS pg - (V tg / KO pg); relative release: V rel = (V tg -V pg) / KO tg.

According to the task:

B \u003d (0.07142-0.1) × 7000 \u003d (-200) million rubles.

Vab \u003d 600 - (7000 / 10) \u003d (-100) million rubles.

Votn \u003d (6000 - 7000) / 10 \u003d (-100) million rubles.

The efficiency of the use of working capital depends on many factors, which can be divided into external factors that influence regardless of the interests of the enterprise, and internal factors that the enterprise can and should actively influence.

External factors include: the general economic situation, tax legislation, conditions for obtaining loans and interest rates on them, the possibility of targeted financing, participation in programs financed from the budget. These and other factors determine the scope in which the company can manipulate the internal factors of working capital.

Significant reserves for increasing the efficiency of the use of working capital lie directly in the enterprise itself. In manufacturing, this applies primarily to inventories. Being one of the components of working capital, they play an important role in ensuring the continuity of the production process. At the same time, inventories represent that part of the means of production that is temporarily not involved in the production process.

Rational organization of inventories is an indispensable condition for increasing the efficiency of the use of working capital. The main ways to reduce inventories come down to their rational use, the elimination of excess stocks of materials, the improvement of rationing, the improvement of the organization of supply, including by establishing clear contractual terms of supply and ensuring their implementation, optimal selection of suppliers, and streamlined transport. An important role belongs to improving the organization of warehouse management.

Accelerating the turnover of working capital allows you to release significant amounts and thus increase the volume of production without additional financial resources, and use the released funds in accordance with the needs of the enterprise.

Latest site content

Control

yiwu city china wholesale. Yiwu city information. Printing equipment

: Yìwū, pall. listen: Yiwu) is located in Jinhua City, Zhejiang Province of China. Collegiate YouTube 1 / 1✪ Video presentation of Yiwu China. Subtitle Description Yiwu City is located in the eastern part of Zhejiang Province (China), Zhe Province

Other questions

Beam profiling machine is a great helper for building materials production

1. The main advantage of the Flagman 4x240 lumber profiling machine design is a very reliable workpiece feeding system during processing: a long pusher on the carriage pushes the workpiece through all spindles, providing a constant force

Calculation

Beam profiling machine is a great helper for building materials production

Modern construction technologies involve the use of high-quality lumber, which can rightly be attributed to profiled timber. This product has a number of advantages (durability, ease of installation and

Terms

Russian trade unions. History and modernity. Presentation on the topic “Join a trade union Attending concerts, performances ...

“Trade unions yesterday, today, tomorrow” Purpose: Ø to give the concepts of trade unions, trade union movement; Ø show their goals of the task; Ø to promote the formation of a positive attitude towards trade unions as a promising factor in Belarusian public life. Tasks: u

Calculation

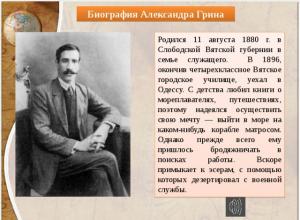

Presentation on the topic "Scarlet Sails" A

A.S. Green "Scarlet Sails" Completed by: student of the 9th "c" class Kugergin Valeria Teacher: Lapina Galina Nikolaevna A.S. Green. Extravaganza "Scarlet Sails" The secret of human happiness The concept of "Scarlet Sails" "This toy told me something, but I did not know what. Then I pr

Online services

Presentation on the topic of variability

Slide 1 "Patterns of variability: modification and mutational variability" 01/28/2013 Lesson topic: The purpose of the lesson: - to form the concept of modification and mutational variability; - consider the mechanism of mutations; - find out the causes of mutations; - to study